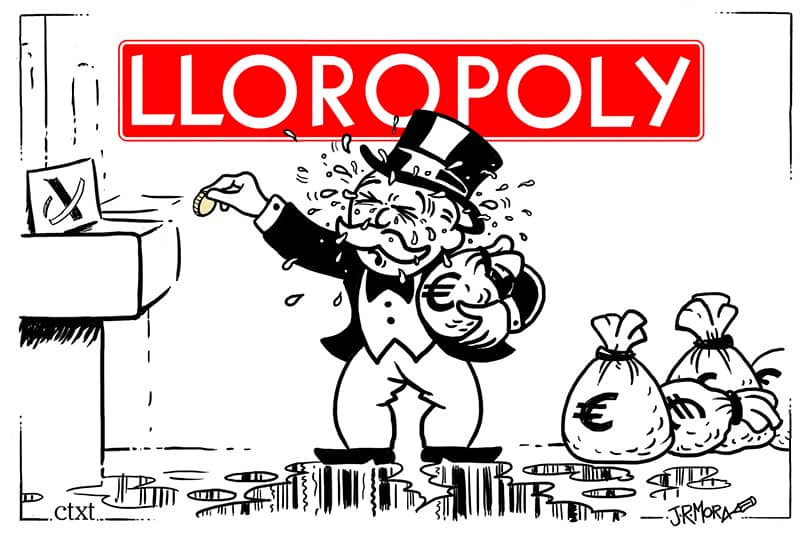

"Crypoly! Tax the rich. Cartoon of 01/10/2022 in CTXT

The Government announced what is popularly known as a "tax on the rich", although the government refers to it as a "solidarity tax" on large fortunes.

This temporary tax will only apply during 2023 and 2024 for net wealth of more than 3 million euros and it is estimated that it will affect some 23,000 taxpayers, 0.1% of the total (one in every 1,000). The government expects to raise around 1.5 billion euros(1)

So this week we have seen some of those wealthy few weeping in the corners as many ordinary countrymen, with less money than the one taking a bath, wept with them in sympathy for the loss of other people's wealth.

The bulk of the general and/or traditional media and the occasional digital media, as well as those that call themselves "economic", left their yolks in their usual yellow catastrophe headlines.

Bonus: Surprise, lowering taxes for the richest only benefits ... the richest. This is the title of an interesting post on the blog"Science and its Demons" in which they remind us, among other things, that the benefits of lowering taxes for those who have the most do not make the money flow happily to those who have less, as the armchair neoliberals claim

"This is what has just been reaffirmed (again, because the list of such studies is getting boringly long) by researchers at King's College. The authors analysed the effects of 30 reforms carried out in 18 OECD countries, including of course the most emblematic ones (such as those of Ronald Reagan or Margaret Thatcher) along with many others from the rest of the developed countries. And when comparing the 5 years before the tax cut for the richest in each country with the 5 years after the "reforms", the results could not be clearer". (Source).

Abstract

The last 50 years has seen a dramatic decline in taxes on the rich across the advanced democracies. There is still fervent debate in both political and academic circles, however, about the economic consequences of this sweeping change in tax policy

This article contributes to this debate by using a newly constructed indicator of taxes on the rich to identify all instances of major tax reductions on the rich in 18 Organisation for Economic Co-operation and Development (OECD) countries between 1965 and 2015. We then estimate the average effects of these major tax reforms on key macroeconomic aggregates

We find tax cuts for the rich lead to higher income inequality in both the short- and medium-term. In contrast, such reforms do not have any significant effect on economic growth or unemployment. Our results therefore provide strong evidence against the influential political-economic idea that tax cuts for the rich 'trickle down' to boost the wider economy.

The economic consequences of major tax cuts for the rich

David Hope, Julian Limberg

Socio-Economic Review, Volume 20, Issue 2, April 2022, Pages 539-559. Licence. Creative Commons CC-BY-NC